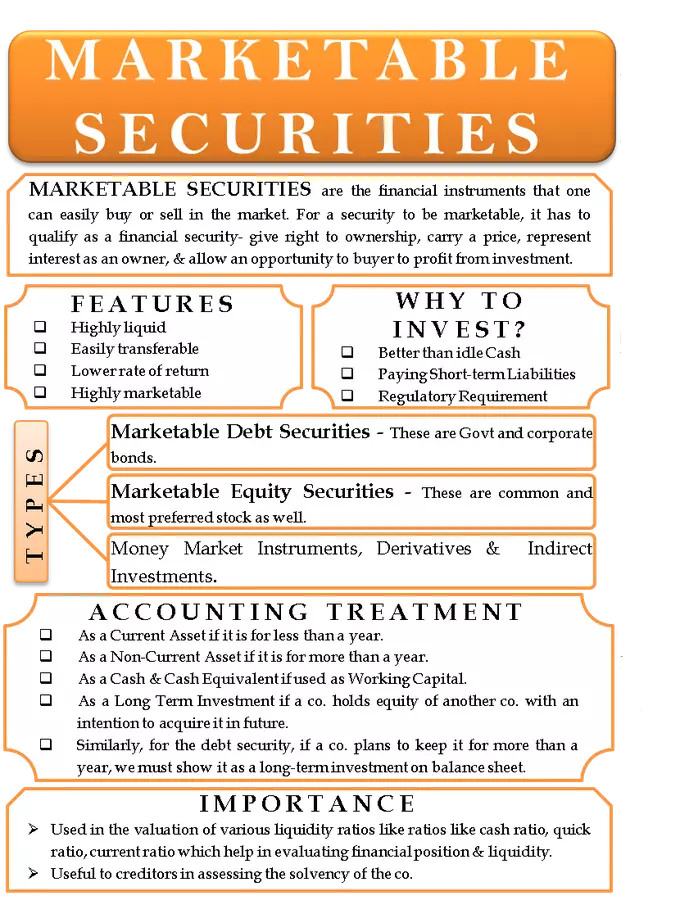

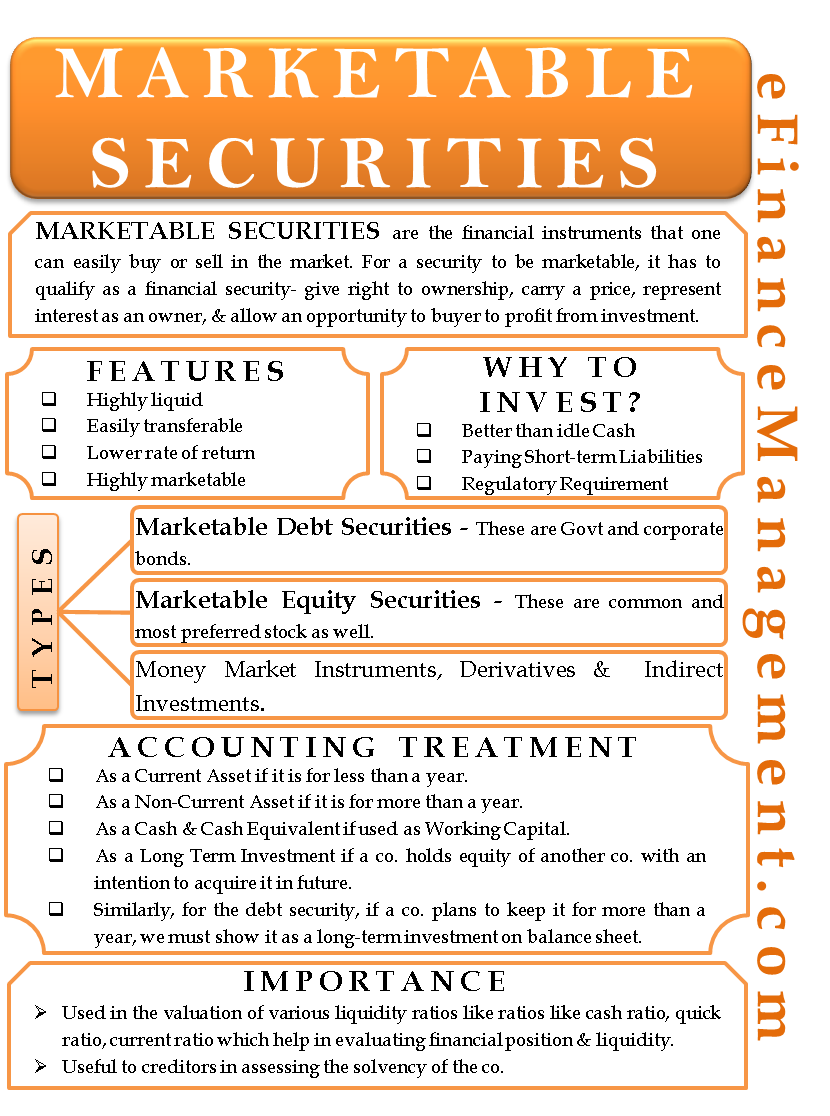

Marketable securities broadly have two groups marketable debt securities and marketable equity securities. Types of Marketable Securities.

/GettyImages-824185000-03c0d898d7e449ac8fef137d17f73dd1.jpg)

Common Examples Of Marketable Securities

One can trade these on the public exchange and their market price is also readily available.

. There are 3 types of Marketable Securities. There are many kinds of marketable securities but they fall into two main categories which are debt and equity securities. In the balance sheet all marketable debt securities are shown as current at the cost until a.

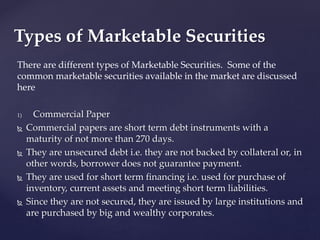

Treasury inflation-protected securities TIPS are those securities. Treasury bills domestic and foreign banks eg certificates of deposit and business corporations eg commercial paper. Now were going to talk about marketable securities which again is still 0 to 20 however there is a market value fair market value.

Stock represents a claim on the companys assets and earnings. A marketable security is a form of security that can be sold or otherwise converted to cash within less than one year. Marketable debt securities are government bonds and corporate bonds.

Some examples of marketable securities that you might be familiar with include Treasury bills money market instruments and commercial paper. In the balance sheet all marketable debt securities are shown as current at the cost until a. The chief feature of marketable securities is that it is easier to trade them and they can be converted into cash whenever required by the investor.

Equity securities which includes stocks. From the figure given below it can be observed that marketable securities are classified into four types- money market securities capital market securities derivatives and indirect investments. These are treasury bills are often purchases at discounted prices and mature in one year or less where the full face value of the mount is received.

These classifications are dependent on certain criteria but also on the history of transactions any given investor or firm has employed in their past accounting practices. In the United States the term broadly covers all traded financial assets and breaks such assets down into three primary categories. Certificate of deposit issued by commercial banks and brokerage companies available in minimum amounts of 100000 which may be traded prior to maturity.

Marketable securities broadly have two groups Marketable debt securities and Marketable equity securities. Call money deposits are available allowing investors to get their money back on demand and there are 1-day overnight deposits. Each of these four marketable.

Bankers acceptance arises from a. -Commercial Certificates of Deposit CDs. As a marketable security the Eurodollar time deposit is like a negotiable certificate of deposit.

These products are considered relatively liquid compared to products that are. They represent the debt which issuers need to pay back to investors holders on the maturity date. Since there is a secondary market or a middleman available buyers and sellers are not required to meet physically.

Government sells to raise money. Marketable debt securities are government bonds and corporate bonds. A stock is a share an individual or a company purchases in the ownership of a company.

Common or preferred unrestricted stock of another business Bankers acceptance notes Commercial paper or short-term notes issued by another corporation to finance debts Exchange-traded Funds ETFs US. Equity shares bonds mutual funds and others are examples of marketable securities. Treasury bills Other types of money market.

Short-term debt obligations the US. Debt securities are the short term debt bond which will be matured in less than a year. There is no direct relationship between the issuer and the investor in case of non-marketable securities.

They usually have low risk of default. Type of Marketable Securities. The common types of marketable securities include.

Most deposit have a maturity of less than a year and they can be sold in the market prior to maturity. One can trade these on the public exchange and their market price is also readily available. So as we look at marketable securities were going to see that theres different ways to account for them.

There are three different classifications of marketable securities. In short Marketable Securities is an investment option for the organization to earn returns on existing cash while maintaining cash flow Cash While Maintaining Cash Flow Cash Flow is the amount of cash or cash equivalent generated consumed by a Company over a given period. SOME DIFFERENT TYPES OF MONEY MARKET SECURITIES Money market securities are generally highly marketable and short-term.

Derivatives which includes options. Debt securities which includes bonds and banknotes. So lets think back again for a minutewe said if its 0 to 20 that was called the.

It proves to be a prerequisite for analyzing the businesss strength profitability scope for. A written promise one. 1 Treasury bills.

Zero-coupons securities STRIPS which are treasury securities separate the principal from the interest and do not make periodic interest payments. Commercial paper represents a short term unsecured promissory note issued to the public in. The bill which is issued by the government and that is issued on discount then face value is called.

They are issued by the US.

Management Of Marketable Securities Indiafreenotes

Marketable Vs Non Marketable Securities The Best Guide 2022

Marketable Securities Stock Photo Alamy

/GettyImages-824185000-03c0d898d7e449ac8fef137d17f73dd1.jpg)

Common Examples Of Marketable Securities

Marketable Securities Meaning Types Importance And More

Classification Of Marketable And Non Marketable Securities Wealth How

Types Of Marketable Securities Qs Study

Classification Of Marketable And Non Marketable Securities Wealth How

0 Comments